Content

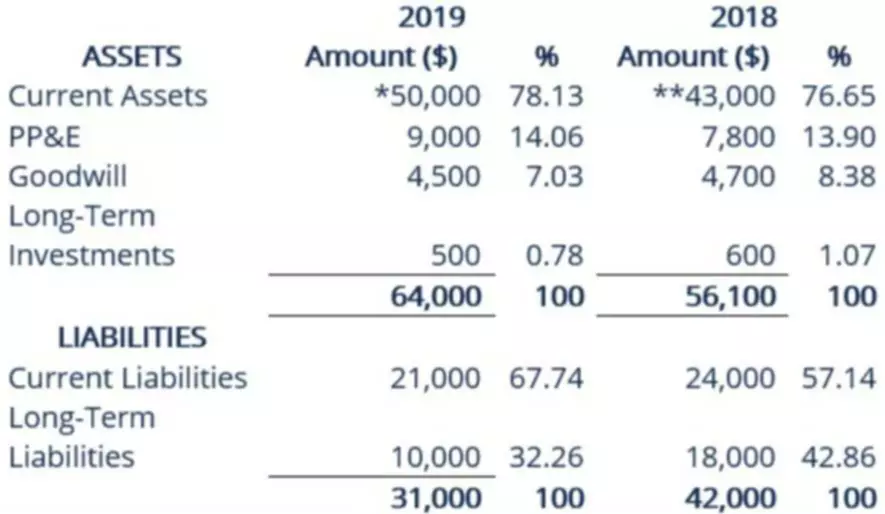

However, if large cash figures are typical of a company’s balance sheet over time, it could be a red flag that management is too shortsighted to know what to do with the money. For you, the small business owner, your balance sheet can show you the scope, organization, and direction of your small business’s financial health. In addition to these categories, most balance sheets will compare your current balances with the balances from a prior period. This could be the reporting period before, or the year before, your current balance sheet. These comparisons allow you to see how your finances are changing over time.

Your balance sheet shows what your business owns , what it owes , and what money is left over for the owners (owner’s equity). Income statements and balance sheets are both financial statements that show a business’s standing but differ in the layout and in the way they’re used.

Add Total Shareholder Equity and Total Liability to Compare to Assets

Both columns list their line items with a total that equals the other, to balance. When creating a balance sheet, the items should be listed in order by liquidity, starting with the most liquid assets, such as cash and inventory on top.

- It provides insights to the users such as investors who can understand the cash-generating ability of your business entity and how cash is utilised.

- Since note 6 is detailing both long and short term provisions, it runs into several pages; hence, for this reason, I will not represent an extract of it.

- This equation can be broken down further by looking at each section in depth.

- You can fund these assets either by borrowing it from the creditors, taking loans from banks , or avail these funds from investors (shareholder’s equity).

- Under IFRS, property used to earn rental income or capital appreciation is considered to be an investment property.

- Current liabilities are due within the year, while noncurrent liabilities are not due within the year.

The results help to drive the regulatory balance sheet reporting obligations of the organization. In the case of our sample Acme Manufacturing’s Balance Sheet, it appears that their financial health is in good standing. However, it would make sense to obtain the previous year’s Balance Sheet to compare any trends that should be addressed in the next fiscal year. It would also be helpful to read the Notes to Consolidated Financial Statements included in the 10-Ks supplied to the U.S. $1,724,000As you can see, Acme Manufacturing’s 2020 assets are not financed equally. Shareholder’s Equity represents 67.6% of their assets while Liabilities represent 32.4% of their assets.

Determine Your Liabilities

There’s plenty more to help you build a lasting, intuitive understanding of math. You will see QuickBooks automatically generating a Balance Sheet Report in the sections Assets, Liabilities, and shareholder’s equity. Hence, your balance sheet should look something like the one given in the example above. Likewise, in the case of liabilities, the short-term liabilities like creditors, short-term loans and advances, etc are recorded at the top of the new Balance Sheet. Whereas, the long-term liabilities including long-term loans and advances are showcased at the bottom. Thus, by calculating the Debt-Equity ratio, they can know if extending additional loans to your business would be safe or risky.

How to Read a Balance Sheet – The Motley Fool

How to Read a Balance Sheet.

Posted: Mon, 11 Apr 2022 20:23:09 GMT [source]

Most importantly, it can help answer questions about whether or not a business is thriving. Is your company experiencing unprecedented growth, or do you need to take steps to increase revenue? You’ll see what your company owns against what it owes, thereby getting a sense for where you currently stand. While Apple has more than $100 billion in current and non-current “other” liabilities — and this is certainly a lot of money — the key point to know is that this is a very broad category. On the current side, this can include things such as payroll obligations, accrued benefits, and other items due within a year. On the non-current side, liabilities can include lease obligations, deferred tax credits, customer deposits, and pension obligations, just to name a few.

Example of a balance sheet

Current assets are things like cash, money owed to the business , and investments. The first part of a cash flow statement analyzes a company’s cash flow from net income or losses. For most companies, this section of the cash flow statement reconciles the net income to the actual cash the company received from or used in its operating activities. To do this, it adjusts net income for any non-cash items and adjusts for any cash that was used or provided by other operating assets and liabilities. Assets are generally listed based on how quickly they will be converted into cash.

A Balance Sheet is a statement showing the assets, liabilities and shareholders’ equity of a business. It provides detailed information in a specifically defined format. The assets on the left will equal the liabilities and equity on the right. When reviewing a balance sheet, the two columns will reflect the balance sheet equation with line-item accounts showing how the two sides add up. A balance sheet reflects the number of assets and liabilities at the final moment of the report or accounting period. Most balance sheet reports are generated for 12 months, although you can set any length of time.

Courses

Each financial situation is different, the advice provided is intended to be general. Please contact your financial or legal advisors for information specific to your situation. All you have to do is organise the various items that you are keeping track of under the three main heads of the balance sheet as mentioned above. There are a number of ways in which you can prepare a new Balance Sheet for your business.

In other words, shareholders’ equity is what you own after you subtract what you owe from your assets. A business’s assets are broken down into fixed assets and current assets. Fixed assets (which are also called https://www.bookstime.com/ non-current assets) include things the business owns, like equipment and land. Fixed assets also include items that are valuable to a company but difficult to turn into cash quickly, like patents and copyrights.

Elements of the Balance Sheet

An asset is a resource controlled by the company and is expected to have an economic value in balance sheet basics the future. Typical examples of assets include plants, machinery, cash, brands, patents etc.

- Gather all financial documents, such as receipts and invoices, pertaining to your business’s assets and liabilities.

- From the note, it is quite clear that the ‘Long term borrowings’ is in the form of ‘interest-free sales tax deferment’.

- This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

- She is a small business contributing writer for a finance website, with prior management experience at a Fortune 100 company and experience as a web producer at a news station.

- To do this, simply subtract all cash paid from cash received and enter the amount on the next line of the cash flow statement.